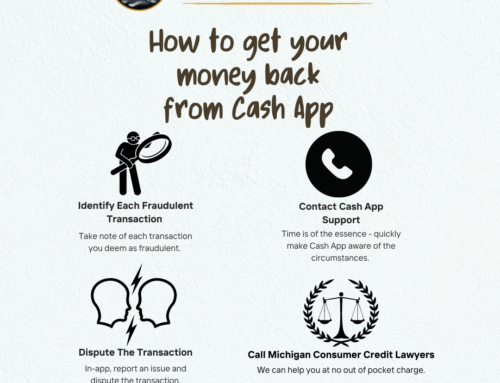

If you would like assistance from attorneys experienced in helping consumers fight financial scams, our firm Michigan Consumer Credit Lawyers stands ready to help you at no out-of-pocket charge to you. You only pay us a fee if you win. Contact us by phone at 248-353-2882 or email us at [email protected] for more information

The Top 5 Cash App Scam Red Flags

Cash App scams exploit the platform’s ease of use and trust factor. Scammers often impersonate legitimate businesses, friends, or even romantic interests to create a sense of familiarity and security. They employ social engineering tactics like urgency, fear, and flattery to manipulate emotions and pressure victims into acting irrationally. Let’s dig into several red flags to watch out for.

Red Flag 1: Unsolicited Requests for Money

One of the most common red flags is unexpected money requests from unknown individuals. These can arrive through Cash App, text messages, emails, or social media DMs. Scammers often use:

- Urgency: Claiming limited-time offers or immediate financial consequences if you don’t send money right away.

- Sob stories: Fabricating emotional situations like lost jobs or sick family members to tug at your heartstrings.

- Threats: Intimidating you with accusations or potential legal action if you refuse to send money.

How to Respond

Faced with an out-of-the-blue money request on Cash App? Don’t panic, but don’t engage either. Here’s how to effectively shut down the scammer and protect yourself:

- Do not engage: Resist the urge to reply, explain your situation, or negotiate. Any interaction validates the scammer and opens doors for further manipulation.

- Report the incident: Within Cash App, open the chat with the sender, tap the three dots, and select “Report.”

- Block the sender: This prevents further contact and protects you from future scams.

- Consider reaching out to legal counsel: If the scam involves significant financial loss or harassment, seek help from a consumer protection attorney.

Red Flag 2: Suspicious Social Media Activity

Sometimes fake Cash App accounts also have a presence on social media, which is another common tactic. These fake social media accounts often have:

- Low follower count: Legitimate Cash App accounts often have larger followings due to their business or influencer status.

- Sporadic activity: Fake accounts may have infrequent posts or engage in random interactions to appear legitimate.

- Lack of verification: Look for the blue checkmark badge, which indicates verification by the platform. The absence of this should raise concerns.

How to Respond

Engaging a suspicious Cash App account on social media? Pump the brakes! Here’s how to spot the fakes and keep your hard-earned cash safe:

- Verify the account: Check for the verification badge and compare the username to the official Cash App account on the platform.

- Research the account: Look for online reviews or mentions of the account to see if others have reported it as a scam.

- Report the account: Each social media platform has its reporting procedure. Use the platform’s designated tool to report the fake account (Twitter, Facebook, Instagram TikTok).

- Ignore and block: Do not engage with the account in any way. Ignoring and blocking are the safest measures.

Remember, always double-check usernames and handles before sending money. If something seems off, even slightly, trust your gut and walk away.

Red Flag 3: Urgent and High-Pressure Tactics

Scammers thrive on manipulating your emotions. One common tactic is creating a sense of urgency that clouds your judgment. They might:

- Claim limited-time offers: These “once-in-a-lifetime” deals often pressure you into making quick decisions before you can properly assess the offer’s legitimacy.

- Threaten dire consequences: Scammers may fabricate impending financial losses, legal troubles, or even physical harm if you don’t send money immediately.

- Use manipulative language: Phrases like “act now!”, “don’t miss out!” or “exclusive opportunity” are red flags designed to bypass your rational thinking and trigger an impulsive response.

How to Respond

Hold your horses if you’re pressured to send cash on Cash App! Don’t let urgency cloud your judgment. Here’s how to spot the scammer’s tricks and make informed financial decisions.

- Take a deep breath: Don’t let the scammer’s urgency dictate your actions. Pause, step back, and assess the situation rationally.

- Verify the information: Do some independent research. Consider contacting the supposed sender through a trusted channel to confirm the urgency and legitimacy of the request.

- Seek trusted advice: Discuss the situation with someone you trust – a friend, family member, attorney, or financial advisor – before making any decisions.

- Walk away if unsure: If something seems fishy or you have doubts, trust your gut. It’s always better to be safe than sorry.

Take your time, do your due diligence, and prioritize your safety over instant gratification.

Red Flag 4: Poor Communication Quality

Effective communication is essential for building trust.

When dealing with Cash App, be wary of interactions with:

- Poor grammar and spelling: Typos, grammatical errors, and unprofessional language often indicate scams. Legitimate businesses invest in clear and concise communication.

- Vague or overly technical terms: Scammers may use confusing language to avoid scrutiny and mask their true intentions. If you don’t understand what they’re saying, it’s a red flag.

- Hesitation to answer questions: Legitimate individuals should be able to answer direct questions and provide clear explanations. If the sender evades your inquiries or gives vague responses, proceed cautiously.

How to Respond

Scammers often use poor communication to mask their intentions and manipulate you into making hasty decisions. Here’s how to deal with this situation:

- Proceed with skepticism: If the communication quality is subpar, approach the interaction with suspicion. Do not make assumptions or fill in the blanks with your interpretations.

- Do not respond: Engaging with the scammer further risks giving them an opening for manipulation. Ignore their messages or block them altogether.

- Report the incident: If the communication involves threats or harassment, report it to Cash App and the relevant authorities.

Clear and professional communication is a hallmark of legitimate interactions. If you encounter anything fishy, err on the side of caution and avoid engaging with the sender.

Red Flag 5: Unusual Requests for Personal Information

Legitimate Cash App transactions rarely require sensitive information like your PIN, bank account details, or Social Security number. Scammers, however, often trick you into revealing this critical data. Be wary of:

- Suspicious justifications: Scammers may invent elaborate stories to justify their request for personal information. For example, they might claim it’s needed for account verification or to “upgrade” your Cash App features.

- Phishing attempts: They may send emails or text messages masquerading as Cash App support, urging you to update your information through a fake website or link.

- Pressure tactics: Scammers may threaten to suspend your account or withhold access to funds if you don’t provide your personal information.

How to Respond

Imagine this: a seemingly urgent message demanding your Cash App PIN or bank details. Before panicking and surrendering your information, take a deep breath and follow these steps to effectively shut down any attempt to breach your financial fortress:

- Never share personal information: This includes your Cash App PIN, bank account details, Social Security number, and other sensitive data. Legitimate transactions rarely require this information.

- Report the request: If someone asks for your personal information on Cash App, report the incident immediately through the app’s reporting feature.

- Enable two-factor authentication: This adds an extra layer of security to your account, making it harder for scammers to gain unauthorized access.

- Double-check before clicking: Never click suspicious links or download attachments from unknown senders. Contact Cash App directly for clarification if you’re unsure about an email or text message.

We Can Help You

If you are in a tough spot with a Cash App scam, our team at Credit Repair Lawyers of America is here to help. We know the ins and outs of protecting consumers from financial scams and can help you at no out-of-pocket charge. You only pay us a fee if you win. Call or email us Michigan Consumer Credit Lawyers For a free consultation at (248) 353-2882 or email us at [email protected] for more information. Let us help you at no out of pocket charge.