Understanding Cash App Fraud

Cash App fraud can take many forms, including:

- Unauthorized Transactions: Money withdrawn or sent without your consent.

- Scams: Fraudulent schemes where you’re tricked into sending money.

- Phishing: Attempts to steal your login credentials to access your account.

Regardless of the type of fraud, the impact can be financially and emotionally distressing. Taking legal action may be necessary to recover your funds. However, you must act quickly.

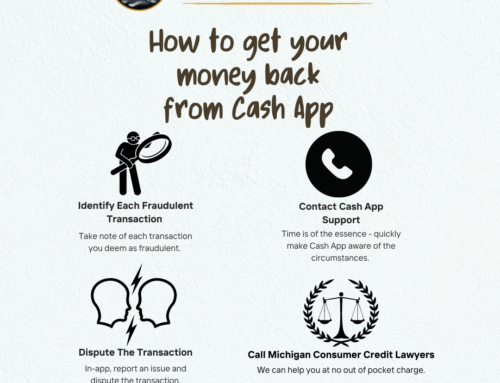

Immediate Steps to Take

Before diving into how a lawyer can help, it’s essential to take some immediate steps when you notice fraudulent activity:

- Report the Fraud: Contact Cash App support immediately through the app and report the issue.

- Notify Your Bank: If your Cash App is linked to your bank account or debit card, inform your bank about the fraudulent activity.

- Change Passwords: Update your Cash App and associated email passwords to prevent further unauthorized access.

- Monitor Your Accounts: Keep a close watch on your financial accounts for additional suspicious activity.

Timing is everything. If you notify your bank within 2 days of discovering the fraud, you can get back everything over $50. If you notify the bank after 2 days but before 60 days, you get back everything except the first $500. After 60 days, you are stuck with the loss.

We can help you at no out of pocket charge.

Under the Electronic Funds Transfers Act (“EFTA”), you have a right to be reimbursed for losses, if you act timely. Moreover, the bank has the burden of proving that these transfers were authorized by you. Under the law, we can and do make the banks pay our fees and costs in a successful action.

We can help you understand your rights. We will give you a candid assessment of your situation and the advice you need to make an informed decision as to how (or if) to proceed with your case. We can file your case in the appropriate forum. Many banks require that disputes be resolved in arbitration rather than court. Arbitration is kind of like stepping into the Twilight Zone as you are never quite certain who the arbitrator will be or what he or she will allow us to do in pursuing your case.

If you have been victimized of bank fraud, don’t stay a victim. Let us get your money back for you.

Call Michigan Consumer Credit Lawyers at (248) 353-2882 for a free, no obligation consultation. Talk with an attorney today to learn your rights and get free advice. If you have a good case, we will not charge you anything out of pocket to pursue your claim to get your money back from the bank. You can also visit us at https://micreditlawyer.com/blog/ for more information or email us at [email protected].

(248)-353-2882