As lawyers, we can make the bank return funds to your account that you did not authorize to be disbursed.

Under the EFTA, however, you do have to act fast. The fast you notify the bank, the more likely you are to get your funds back. Although, often times, even if you act quickly, banks will find a reason to deny your request. If they do, call us and lets see if we can convince the bank to restore your funds. Our services will cost you nothing out of pocket because under the law, the bank pays our fees and costs.

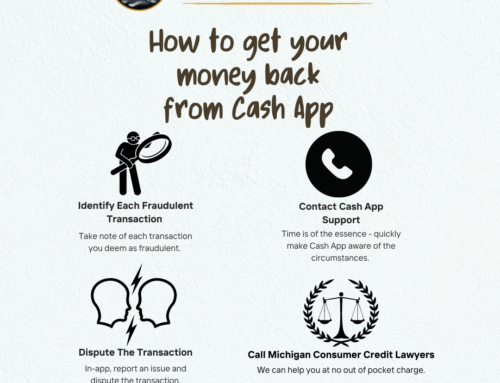

Steps you need to take if your bank account was drained through your Cash App.

Step 1 – Call your bank and tell them that you have been scammed. Write down the date and time that you called the bank because this is going to be very important information in your case. Why? The sooner you let the bank know, the more money you can get back from it.

- If you notify the bank within 2 days of learning that you have been scammed, you are only liable for the first $50. You can get everything above this amount refunded to you.

- If you notify the bank after 2 days but before 60 days of the date on the bank statement that has the fraudulent transactions, you can get back everything over $500.

- After 60 days, you don’t have a right to recover anything.

Moral of the story – Let your bank know that you have been scammed as soon as you learn about it. Again, be sure to write down the date and time you notified the bank.

The Bank must investigate your Dispute

The burden of proving that you authorized the fraudulent charges is on the bank. Yep, that was not a typo. The bank has the duty to prove that you actually authorized the charges. If the bank can prove that you benefitted in anyway from the bogus charges, were somehow complicit in making those charges or you willingly gave someone your credentials and they exceeded your permission, the bank is not responsible for refunding your money. Short of those things, it is required to refund your money.

When the bank concludes its investigation, it must inform you of its decision and the reasons for its decision. It must also provide you with documents that it relied on in making its decision.

You have one year to file your lawsuit against the bank to make it repay you.

If the bank denies your dispute, you have a very short 1 year time perido within which to file your lawsuit against bank, starting from the date of the bank’s decision. If you have a good case, you should hire us as this lawsuit will not cost you anything out of pocket as the bank is liable for your costs and attorneys fees. While the law does not explicitly give you a right to additional damages above the liability caps above, it does not prohibit it either. Many other consumer laws give the consumer a right to emotional and other damages.

If you have been scammed by cash app scammers, let us get your money back for you. Our services will cost you nothing out of pocket.